Property Bridges aims to make investing in property in Ireland as effective as possible for investors while minimising the risks traditionally associated with property investments. Included in our due diligence process is the requirement that we have a first fixed charge over the property in question as security for the loan.

In this blog post, we highlight what it means to have a first fixed charge as security in place and outline the different security types.

What is a first fixed charge?

A first fixed charge ensures that the charge holder (i.e. Property Bridges) is first to be paid back upon the sale of the property or if the property goes into default. Hence it is known as a secured charge. Property Bridges will be first in the queue for repayment.

To understand what ‘first fixed charge security’ is and the importance it plays in lending, let’s take a step back and use an everyday example.

When you take out a mortgage, the bank provides you with money to purchase your home. In return, you will give the bank a first fixed charge over your home. You pay the mortgage amount back over the term of the mortgage. If you wish to sell the house, you can only do so once you repay the outstanding mortgage. This is done by our solicitor holding the sales price in trust on the day of closing and then they hand over the amount of the outstanding mortgage to the bank. The bank will then issue a deed of release.

However, if you fail to service the loan, the bank may repossess the house and sell it in order to reclaim the amount outstanding.

Property Bridges is like the bank when insisting on a first fixed charge when lending to a developer. The developer pays us back upon the completion and sale of the development. In the worst-case scenario and the developer go into default, Property Bridges is first in the queue to receive payment upon the sale of the asset. Only once we are fully paid, other secured and unsecured creditors will then be paid.

What are the different levels of security?

As discussed, there are different security charges being;

- A first fixed charge: ensures that the charge holder (i.e. Property Bridges) is first to be paid back upon the sale of the property or if the property goes into default. Hence it is known as a secured charge. Property Bridges will be first in the queue for repayment.

A first fixed charge holder also has the right to take control of the asset if it defaults on repayments.

In Ireland, a first fixed charge is registered on the property folio by thee land registry as the number one burden on the property.

- A second fixed charge: the charge holder is only paid once the first fixed charge holder is paid in full.

- Equity investor/an unsecured creditor: A lender who does not have a fixed charge is said to have an unsecured loan. They will only receive payment once all the fixed charges are fully repaid. Typically, a developer who puts in cash (known as equity) is an unsecured creditor.

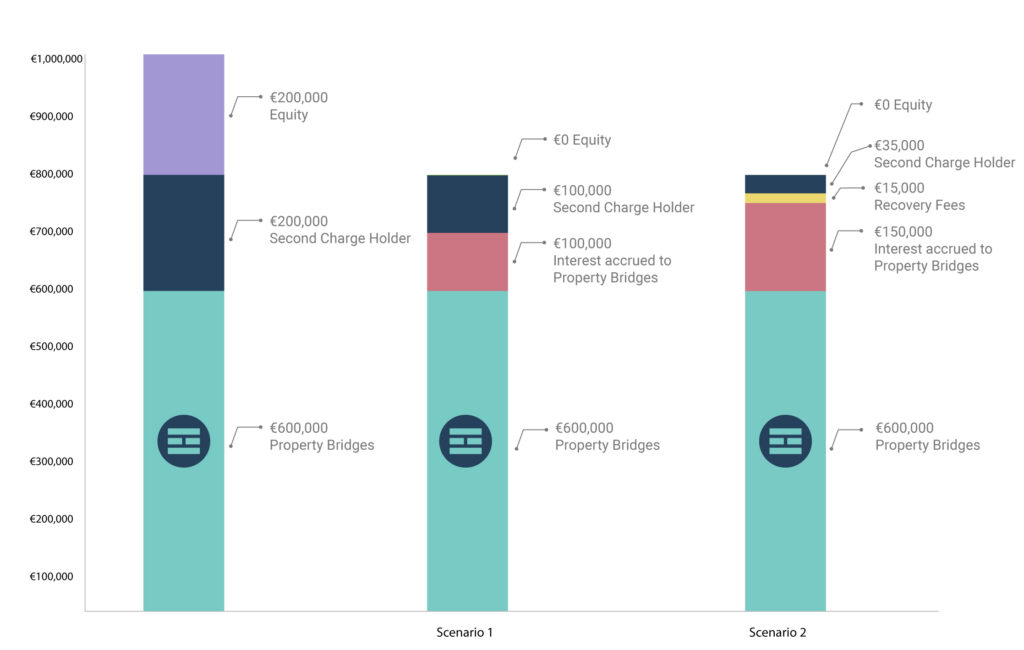

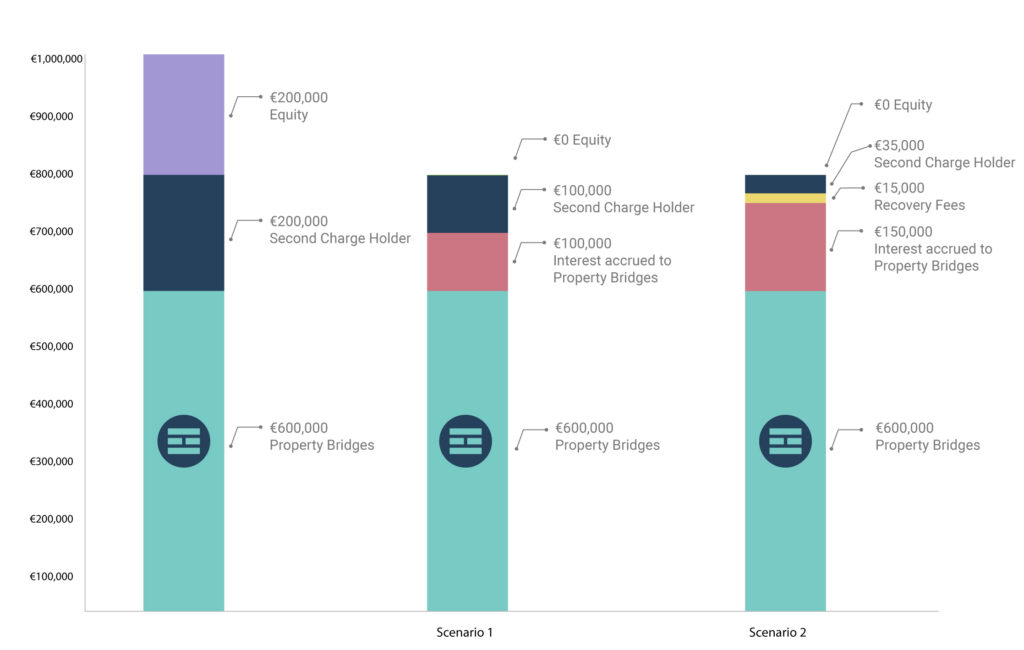

The below image notes the key points in the difference between a first fixed charge and second fixed charge.

Key Points to Note When investing

It is key that you need to know what type of security is against the loan you may invest in what that means for the investment and how that your capital is at risk.

How First Charge Security works in practice

Property Bridges lends to a maximum of 70% of the property’s value. This is known as maximum Loan To Value (“LTV”). This means that for a property valued at €1,000,000, PB lends €700,000 with the developer contributing the remaining 30% being €300,000 euros through either his/her own cash, a second fixed charge or both.

The property’s value could fall by 30% to €700,000 and PB/the investors capital of €700,000 is still protected. The developer’s 30% paid in cash (known as equity) ranks behind PB’s senior first fix charge and therefore is wiped out completely. Only when the value of the property drops below €700,000 does PB/the investors begin to lose on their investment.

PB only lend to 70% on the safest investments, usually social housing where a government backed entity has agreed to purchase the property (known as forward funding) before PB issues any funding. Consequently, LTV is less relevant as the government backed entity will pay the agreed price regardless if the price falls…or indeed rises!

For open market sales, we generally insist on a more conservative LTV of up to 60%.

For example, here are two pessimistic circumstances illustrated through the bar charts with a 60% LTV on a property valued at €1,000,000.

In the first circumstance (bar 2 in the chart), the site does not increase in value due to inactivity (i.e. no works completed on the site). 12 months of interest at 10% per annum accrues (€100,000) and the property value drops by 20% (to €800,000).

If the site is then sold to pay back the debt; then

- PB/the investors’ debt and interest can be repaid in full;

- only 50% (being €100,000) is repaid to the second fixed charge holder; and

- the entire equity investment of the developer is lost.

In the second circumstance (bar 3 in the chart), again the site does not increase in value due to inactivity (i.e. no works completed on the site). The site is repossessed (recovery fees of €15,000) after 12 months and a further 6 months is taken to dispose of the site resulting in 18 months of interest at 10% per annum (€150,000). The site value is 15% lower than the initial value (to €850,000).

If the site is then sold to pay back the debt; then

- again PB/the investors’ debt, interest and recovery fees are repaid in full;

- just 16.25% (€35,000) is repaid to the second fixed charge holder; and

- again, the entire equity investment of the developer is lost.

In summary, remember that during downturn scenarios, it is essential to have first fixed charge security. It allows for the priority of recovery of capital, the interest accrued, the payment of recovery fees and for the control of the recovery process. Second fixed charge security ranks after it while equity is last and thus the most volatile.

Consequently, if you’re contemplating to invest in an investment that only offers second charge fixed security, ask yourself is the significantly greater risk worth the return on investment?